Snow Plow Insurance FAQs

1 Does my regular truck insurance cover snowplowing?

No, regular car insurance typically will not cover you if you need to file a claim for damage that happened while using your truck to provider snow plowing services. You will most likely need to get extra coverage for that. Talk to your current insurance provider to make sure you’re fully covered.

2 What kind of insurance do I need to plow snow for profit?

You need commercial insurance coverage that covers your vehicle, your plow, and other equipment/attachments like a salt-spreader if you have one. Normal truck insurance will not cover damage if you’re snowplowing someone else’s property and/or as a business. You also need liability coverage for commercial snowplowing, although, really, even if you just have a plow for your own mile-long driveway, make sure your residential policy covers liability. When it comes to commercial insurance, you need more than coverage that barely replaces a bent mailbox. You need snowplowing liability coverage that doesn’t leave you homeless if someone’s kid runs out in front of you or you smash into the 18” tall ornamental stone wall that was built by great-great grandpa in 1806.

3 Do I need an umbrella policy?

Yes! If you’re taking money for snowplowing, you’re running a business, even if it’s not your day job. Accidents happen, and if someone sues you, you don’t know what could happen. An umbrella policy helps protect your personal assets—up to its limit, of course. The additional premium may be only a few hundred dollars a year for the umbrella, but your other coverages will have required minimum coverages that may be above what you wanted. Have a serious discussion with an insurance agent who understands commercial enterprises about your snowplowing insurance needs.

4 Do I need snowplow insurance for subcontractors?

That depends upon their status with you. If they are truly an independent contractor or subcontractor, they need their own snowplow insurance and their own equipment. You need a copy of their policy (the face sheet should be fine but check with your insurance provider to be safe). The requirement that they have insurance should be written out on a contract between them and you. The contract should state that they are responsible for their own insurance, any damages and whatever else involved, of course, like truck, wear and tear, supplies. You’ll be sued if they are sued, but at least you’ll have your ducks in a row. If they are employees, not only do they need to be covered on your commercial snow plowing insurance policies, but you also then need workers’ compensation insurance and, in some states, you may have to offer additional employee benefits. That’s why small businesses prefer independent contractors.

5 What is a subcontractor versus an employee for snow plowing?

There’s a lot of hot jibber-jabber about what an independent contractor is versus an employee, but the bottom line is that the IRS cares, and they say the definition comes down to “control.” If you set the person’s hours, tell them where to be when, train them, furnish their equipment (do they drive your truck when you’re unavailable?), or they get all their livelihood from you, they may be an employee. Get this straightened out and make your insurer aware of their status.

6 Do you need snow plowing insurance year-round?

No. You can request a policy that covers snow plowing from November 1 through April 1, or whatever best covers you for your local winter season. It may save you a few dollars, but in the long run, it may not be worth it. If there’s a gigantic snowfall on October 31, you could be dodging gremlins, ghosts, and superheroes without snow plowing insurance—and ghosts can be hard to see. Talk to your insurance company to make sure you can get covered whenever the first snow storm hits.

7 Can I get insurance that only covers when I am plowing?

Maybe, depending upon your state. It likely would only be liability coverage, and it’s probably expensive in comparison for what you’re getting with a season-long or year-long policy. In addition, you would have to make sure your regular (residential) truck insurer is OK with you operating commercially (I doubt it). Plus, you still must ask for insurance coverage before you do the job, which will be at least a day’s notice. That makes it unlikely you can go out when an unexpected squall hits the area at 4 p.m. Are you really interested in this coverage? Unless you just want to earn a few dollars when the occasional blizzard comes into the area, it’s probably not worth it.

8 How expensive is snow plowing insurance?

That varies widely, and you already know that, but sure, why not ask? The cost is calculated on limits. Online estimates range from $50 a month to over $6,000 a year, depending upon the scope of your business and what risk you’re willing to accept. Remember: Insurance is a risk-calculated business. The insurer is betting you’ll get into trouble, but you’re betting you won’t (especially when you go with low limits and/or high deductibles to save a few dollars on premiums). You will have to adhere to state-mandate minimums, but nearly any insurance agent is going to tell you to make yours a $1 million minimum liability coverage and still recommend that umbrella (if you talk to a lawyer, theywill probably say more, if you’re doing commercial properties). You can risk lower coverages on collision but on liability. no. Flexible Flyers are still aptly named.

9 Do I need snow plowing insurance if I just do the church and a couple of neighbor properties?

Yes. If you’re taking money, you need insurance. Frankly, if you’re doing it out of the goodness of your heart, you should still check with your insurer to be sure you’re covered for liability, at the ver least.

10 Do the properties I plow affect my insurance coverage?

Yes. While it should now be clear that if you get money for snowplowing, you need commercial insurance, it may not be clear that the insurance will likely be written specifically to what you’re plowing. If you start out just doing a couple dozen driveways but suddenly land that shopping-mall contract, consult your insurance agent immediately. You may have a provision in your contract that only covers jobs under 10,000 square feet or something along those lines.

Posted on October 20, 2022

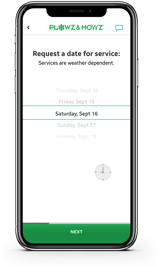

Looking for more landscaping jobs?

There’s an app for that.

Download our free landscaper app to book and manage landscaping, lawn care, and snow removal jobs anytime, anywhere.