Mileage vs. Actual Expenses for Snowplow Businesses

Keeping accurate business records for snowplowing is critical to your financial success. First, get a certified public account (CPA) to do your taxes—not the tax service that pops up next to the local laundromat at tax time. Although you can do the daily work yourself and save some bucks, I wouldn’t recommend a do-it-yourself software tax program. It may seem like an inexpensive way to go, and the ads make it appear like you’re getting professional help, but these programs still come down to “garbage in, garbage out.” And the cost of doing your taxes is a business expense.

Regardless of who or what fills out your tax forms, you must keep accurate business records and present them in a professional manner, even if no one ever looks at them. It’s wise to store all your records permanently in a plastic, waterproof container for every year you’ve been in business. That’s because, if you get audited and there’s a question, you may find the IRS agent’s curiosity extends to other years.

Remember that paper backup for every expense is a necessity. Record all receipts weekly and file them by month. You can file all your receipts electronically, too, and you probably should in case of fire or flood. No backup method is inexcusable, really.

Consider every expense associated with your vehicle, write it down in your expenses book (or on an app if you prefer), and document the receipt. Remember that many receipts fade over the year, especially if exposed to light, so make a photocopy of each one and attach the original or scan the receipt into your computer or take a photograph of it (back up everything!).

Every receipt matters. Record on the receipt why you made the purchase. For example, if your receipt just lists an item number, write on the receipt what it was, such as “one can of oil.” Never figure, “Oh, it was just a couple of bucks” and toss the receipt. Remember that one snowflake is nothing, but they become powerful when you put them all together.

With truck expenses, it’s wise to calculate both the IRS standard mileage rate and a percentage of the actual expenses associated with the truck, which is based on the percentage of miles that were business-associated, to see where you will do better. It’s arguable which method is better overall, but with gas prices skyrocketing and the amount for a standard mileage deduction set at 56¢ per mile for 2021 and 2022, it pays to do both methods and use the one that works best for you at tax time.

For example, if you put 10,000 miles on the truck in 2021, and 2,500 of them were associated with plowing, you can deduct 25% of all expenses associated with that truck on your income tax. Using the mileage method, that comes to $1,400 in deductions. If you use the percentage method, it depends upon what you had to purchase. One year, you might need a new transmission—and that $1,400 is probably not going to cover it.

Expenses that may be associated with your vehicle include:

- • auto clubs

- • lease or purchase payments

- • washes

- • cell phone and wireless plans

- • gas, oil, windshield wiper fluid, tires, air filters, repairs, etc.

- • insurance for the vehicle

- • licenses and registration fees

- • parking fees

- • repairs (every bolt, snap, and major repair)

- • replacement items, like worn seat covers, broken taillights, heated steering wheel covers

- • tolls

No matter which system you use, however, you need to record your mileage. You need a logbook in your truck or you can use a Smartphone app (there are many to choose among). Record a starting mileage for the year, and you must record business mileage every day, especially if you use that truck for anything other than business. You will also need to record the mileage on the vehicle on December 31. Daily entries should look like:

- • Date: January 2, 2022

- • Purpose: Morning plowing contracts (list of names that you did that day)

- • Starting mileage: 10,290

- • Finishing mileage: 10,345

- • Total mileage: 55 miles

If you must stop and make a side trip to pick up the kids at daycare, for example, you need to record the stop and starts for your plowing and then a second entry for when you do return to plowing. Here’s the thing: If you’re audited, you will learn there is no such thing as over-documenting, but you will be denied a deduction if you don’t have proof/backup of doing the work.

For more information, you can look around the IRS website (https://www.irs.gov/taxtopics/tc510) or, as we suggested in the beginning, contact a reputable accountant and become an established client now, before tax time. The sooner you start down the right path, the easier and more profitable the work.

Posted on January 7, 2022

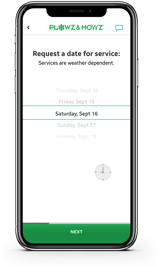

Looking for more landscaping jobs?

There’s an app for that.

Download our free landscaper app to book and manage landscaping, lawn care, and snow removal jobs anytime, anywhere.